does kentucky have sales tax on cars

How much is property tax on a vehicle in Kentucky. Kentucky Sales Tax on Car Purchases.

Tax Season Maximize Your Money At Northern Kentucky Auto Sales We Have Quality Rebuilt Title Vehicles All Year Long Don T Overpay For Your Next Vehicle During Tax Season By

How to Calculate Kentucky Sales Tax on a Car.

. Are services subject to sales tax in Kentucky. Classic cars have a rolling tax exemption ie vehicles manufactured more than 40 years before 1 January of that year are automatically. What Is The Sales Tax In Kentucky.

Usage Tax A six percent. How much is sales tax on a car in Kentucky. Motor Vehicle Usage Tax.

To calculate Kentuckys sales and use tax multiply the purchase. Ad Get Kentucky Tax Rate By Zip. Kentucky does not charge any additional local or use tax.

Does Kentucky have sales and use tax. There are no local. Free Unlimited Searches Try Now.

Kentucky does not have additional sales taxes imposed by a city or. The state of Kentucky has a flat sales tax of 6 on car sales. For example an item that costs 100 will have a tax of 6 for a total of 106 100 times 06 equals.

The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base of. Best solution Kentuckys sales and use tax rate is six percent 6. The Kentucky sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the KY state tax.

Instead of implementing a rental tax on motor vehicles Kentucky charges a motor vehicle usage tax of 6 percent for every motor vehicle used in Kentucky. Estate tax Beginning in 2005 the state death tax credit was replaced by a deduction for state death taxes paid until the repeal of the federal estate tax in 2010. To calculate Kentuckys sales and use tax multiply the purchase price by 6 percent 006.

The state tax rate for historic motor vehicles is 25 cents per 100. The state tax rate for non-historic vehicles is 45 cents per 100 of value. Does kentucky have a state sales tax.

Vehicles purchases are some of the largest sales commonly made in Kentucky which means that they can lead to a hefty sales tax bill. The KY sales tax applicable to the sale of cars boats and real estate sales may. Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all.

Kentucky Sales Tax Small Business Guide Truic

Used Cars Of Kentucky For Sale With Photos Cargurus

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Valuations Increase By 40 Here S What You Can Do If Your Car S Value Jumps This Year Span Class Tnt Section Tag No Link News Span Wpsd Local 6

How Do Electric Car Tax Credits Work In Kentucky Purchase Ford Lincoln

Kentucky House Votes To Give Relief On Vehicle Tax Bills News Wdrb Com

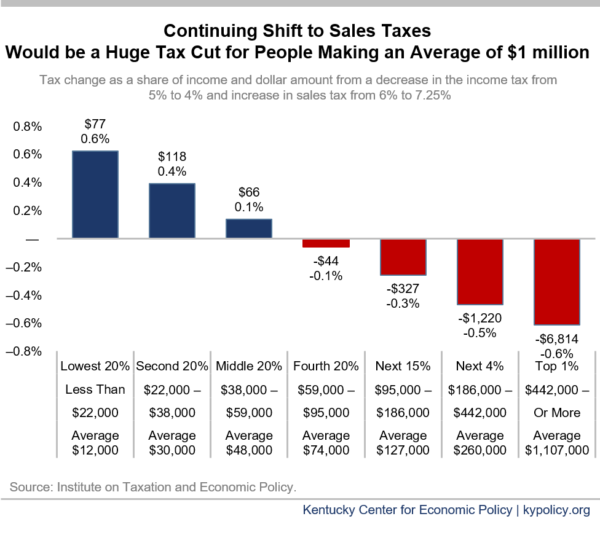

Further Shift From The Income Tax To The Sales Tax Is Bad For Kentucky Kentucky Center For Economic Policy

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

Kentucky S Car Tax How Fair Is It Whas11 Com

Bill Would Place Fee On Kentucky Electric Car Owners Who Don T Pay Gas Tax

Kentucky Tax Reform Here S How Your Taxes Will Change Under Gop Plan

Kentucky Sales Tax Starts July 1 For Gyms Auto Repair

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZZOSE7GMGBBLVCNU56IH3DZWVA.png)

Gov Beshear Vehicle Property Tax Refunds To Be Mailed Soon

Motor Vehicle Taxes Department Of Revenue

Ky Lawmakers Propose Bills To Mediate Car Tax Increases

Used Lincoln Town Car For Sale In Louisville Ky Cargurus

Governor Andy Beshear On Twitter Under Kentucky State Law Only The Kentucky General Assembly Can Exempt All Or Any Portion Of The Property Tax Applied To Motor Vehicles But For The First

Kentucky Sales Tax Form 10a100 2015 Fill Out Sign Online Dochub